Christmas Week, Santa Rally continues, Dollar weakens

The Santa Rally continued today and indices were generally up, despite the Capital Goods miss at 1330. In forex, gold and most currencies were up against USD, the exception being GBP which continued last week’s fade as traders remember than a fast Brexit is not necessarily a good Brexit. Oil and yields were up in line with the equity mood.

Tuesday December 24

The half-day before Christmas had no news, and the sentiment in indices and Oil continued. Forex hardly moved at all, the largest shift being a 0.14% slip in CAD. However there was a little trimming of risk with Gold adding $15 and a pullback in yields.

Wednesday December 25

All major world markets except Japan are closed for Christmas Day. NKY rose slightly and JPY fell.

Thursday December 26

Another indices rally as the US reopened, although Europe was closed for Boxing Day. In thin trading, there was a notable move up in Gold and Oil, and their proxy commodity currencies AUD and CAD. Yields slipped slightly.

Friday December 27

Another very light day due to the holidays. Markets rallied again at first today but then took a breather and pulled back to close roughly flat. Gold and Oil also paused their rallies. There was a notable move down in USD, with DXY fading over 0.5%, although this cannot be attributed to any news, more likely the move was amplified by the reduced volume. Yields fell again, this time in line with the equity pause.

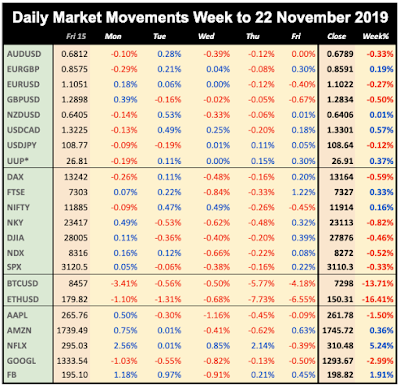

WEEKLY PRICE MOVEMENT

The best index, as is often the case in risk-on times was NDX, and the best forex pair was NZDJPY. Cryptos were flat despite not being tied to exchange holidays. It was AAPL and AMZN’s turn to shine this week from the FANG set.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK (all times are GMT)

(Calendar High volatility items are in bold)

- New Year Week

- Thin Trading again

- Triggers for sentiment switch

- Key US PMI

Monday December 30

Markets are closed today in Australia and Russia, and Germany closes early. Thin trading means the news may generate outsized moves.

07:00 EUR Germany Retail Sales

14:45 USD Chicago PMI

15:00 USD US Pending Home Sales

Tuesday December 31

Markets are closed in Australia, Russia, Japan and Germany, and Switzerland and Spain have a half-day.

The final day of the month, quarter and year together with the thin trading, and the traditional seasonal sentiment may produce outsized volatility.

01:00 CNY China Caixin Manuf PMI (e51.7 p51.8)

14:00 USD US Housing/Home Price Indices

15:00 USD US Consumer Confidence

Wednesday January 01

Markets are closed everywhere today for the New Year holiday. Even Japan. The Aussie PMI is of course issued on Jan 2, local time.

22:00 AUD Commonwealth Bank Manufacturing PMI

Thursday January 02

A new calendar year (and quarter) which may presage a change in sentiment. Sensitive data today in the form a raft of manufacturing PMIs which have been under pressure recently, and the Fed minutes of their last meeting.

01:45 CNY China Caixin Manuf PMI

08:55 EUR Germany Markit Manuf PMI

09:30 GBP UK Markit Manuf PMI

13:30 USD US Jobless Claims

14:30 CAD Canada Markit Manuf PMI

14:45 USD US Markit Manuf PMI

19:00 USD FOMC Minutes

Friday January 03

Note that despite this being the first Friday of the month, Non-Farm Payrolls are actually next week (10th). Today’s news is the most important of the week, particularly the ISM PMI. A return above 50 would be very bullish for markets.

08:55 EUR Germany Unemployment Rate/Change

13:00 EUR Germany Prelim YoY CPI (p1.2%)

15:00 USD ISM Manufacturing PMI (e49 p48.1)

18:15 CAD BoC Wilkins speech

This report is published every week as an email by MatrixTrade.com - you can sign up to receive it here. This blog is supported solely by advertising, so if any of the ads interest you, please click on them. If you want notification when the blog is updated, please follow me on Twitter, Facebook, Stocktwits, TradingView or Linkedin (all open in separate windows). Details of how I compile the report are here.