Trade war flare-up, New all-time highs briefly, Sterling election fears

Mon Nov 18

In the absence of news today, equities drifted. SPX closed flat. Other indices were slightly up except DAX. The dollar fell against most currencies and Gold, but only GBP showed any serious move up, on election hopes. Only AUD and NZD were down. Oil and yields also fell.

Tuesday November 19

Poor earnings from HD set the tone for a disappointing day. After briefly touching a new ATH, SPX (and NKY) fell. So did NDX but it still managed to close green. The stronger dollar helped European indices to post nugatory gains. It was also Turnaround Tuesday for DXY, although this was only from GBP and CAD pulling back. EUR was flat, and JPY actually rose, along with Gold and Bonds, (and Oil fell), all in line with the equity pullback. AUD and NZD once again were contrary, both rising sharply after the hawkish RBA minutes and the GDT milk beat.

Wednesday November 20

The US passed a bill today to annually re-examine Hong Kong’s special status, infuriating Beijing. President Trump also threatened to increase China tariffs if the US is unable make a deal. Naturally the markets didn’t like it, but interestingly, when they were expecting positive news, they got a negative, yet after an initial spike down, There was however, some relief from the Fed minutes (SPX only came off down 0.38% on the day. NDX fared a little worse at -0.62%. Foreign indices also fell. The dollar was up generally (except with EUR which held its own to remain flat). Oil was up after the EIA beat, and Gold was flat. Yields were down in line with the equity pullback.

Thursday November 21

The sentiment from Wednesday continued today at first although there was some recovery into the close. The Philly Fed Manufacturing survey beat was tempered by misses in Jobless Claims and Existing Home Sales. The dollar was virtually flat, with small CAD advance, following Oil, and pullbacks elsewhere (including Gold). Yields were slightly down.

Friday November 22

Indices were directionless until all three US Market PMIs beat at 1445, as did the Michigan Sentiment print 15 minutes later. Non-US indices followed suit, although less markedly. The dollar was much stronger and broke out of the range it had been holding all week, mainly due to sharp moves down in EUR (after their Markit PMIs miss) and GBP (as polls show PM Johnson’s election lead narrowing). Other currencies and Gold were only slightly down, as was Oil and yields.

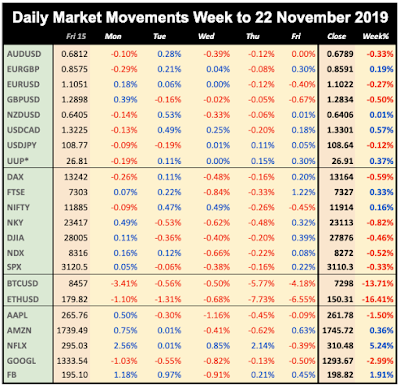

WEEKLY PRICE MOVEMENT

Biggest index mover in this quieter week was NKY, down 0.82%. Currencies were also muted, with a GBPJPY short the best trade. Cryptos started moving again, to the downside, with big losses in both BTC and ETH. FANGS were very mixed, with a notable strong performance from NFLX.

Biggest index mover in this quieter week was NKY, down 0.82%. Currencies were also muted, with a GBPJPY short the best trade. Cryptos started moving again, to the downside, with big losses in both BTC and ETH. FANGS were very mixed, with a notable strong performance from NFLX.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK (all times are GMT)

(Calendar High volatility items are in bold)

- Thanksgiving 3.5 day week

- Trade war still rumbles on

- US and Canada GDP

- Final Powell speech before blackout

Monday November 25

China has apparently invited US officials to Beijing again, but it seems the US is looking for further concessions first. All this could generate market-moving trade news at any point, and of course, a Presidential tweet or two. There is a rate decision on ILS (15bp cut expected).

09:00 EUR Germany IFO Business Sentiment

12:30 USD Chicago Fed National Activity Index

23:50 AUD RBA Debelle speech

Tuesday November 26

Chair Powell’s speech at 7pm EDT in RI is the last before the blackout prior to the Dec 11 FOMC rate decision. A few smaller retailers report earnings today.

00:00 USD Fed Chair Powell speech

07:00 EUR Germany Gfk Consumer Confidence Survey (Dec)

09:05 AUD RBA Governor Lowe speech

14:00 USD US Home Price Indices

15:00 USD US Consumer Confidence

18:00 USD Fed Brainard speech

20:00 NZD RBNZ Financial Stability Report

21:45 NZD NZ Imports/Exports/Trade Balance

Wednesday November 27

A whole raft of economic releases at 1330 before the final full day of this week should make for busy trading and volatility.

13:30 USD US PCE/Personal Income

13:30 USD US Prelim 19Q3 GDP (e1.9% p1.9%)

13:30 USD US Jobless Claims (Nov 22)

13:30 USD US ND Capital Goods (e-0.2% p-0.6%)

15:00 USD US Pending Home Sales

19:00 USD Fed Beige Book

23:50 JPY Japan Retail Sales

Thursday, November 28

US Markets are closed today for Thanksgiving. All other world markets are open, as of course are US futures. German CPI is the main print of the day.

10:00 EUR Eurozone Business Climate

13:00 EUR Germany Prelim CPI YoY (e1.3% p0.9%)

13:30 CAD Canada Current Account (Q3)

22:00 NZD ANZ - Roy Morgan Consumer Confidence

23:30 JPY Tokyo CPI YoY (e0.6% p0.5%)

23:30 JPY Japan Jobs/Unemployment

Friday, November 29

US markets are only open for a half-day today (until 1pm EDT 6pm GMT). Note the very bullish estimate for the final Canadian Q3 GDP print. There is a rate decision on KRW. Markets are closed all day in Romania (not Scotland!) today for St Andrews day.

08:55 EUR Germany Unemployment Rate/Change

10:00 EUR Eurozone CPI YoY (Core e1.2% p1.1%)

10:00 EUR Eurozone Unemployment Rate

13:30 CAD Canada Final 19Q3 GDP (e5.4% p3.7%)

14:45 USD Chicago PMI

This report is published every week as an email by MatrixTrade.com - you can sign up to receive it here. This blog is supported solely by advertising, so if any of the ads interest you, please click on them. If you want notification when the blog is updated, please follow me on Twitter, Facebook, Stocktwits, TradingView or Linkedin (all open in separate windows). Details of how I compile the report are here.