Fed hint of taper acceleration adds to omicron misery.

MY CALL THIS WEEK : BUY NZDJPY

THIS WEEKThis week, the Omicron variant continued to spread, albeit slowly, but a warning from MRNA that their vaccine may be less effective weighed on the market, and indeed on their own stock which, unlike fellow vaccine producer PFE, was also down. Of more concern to markets was Fed Chair Powell's testimony to the Senate where he explicitly confirmed that inflation is no longer 'transitory', and indicated that the rate of taper may be accelerated (ie to finish before June 2022). If the DJI had not already had three down weeks, at one point 7% off its last high, the drop might have been worse. All indices were down except FTSE which rose on sterling weakness.

The dollar was strong against commodity/risk currencies AUD, NZD and CAD, and indeed GBP, although a flat Euro and safe haven yen appreciation led to a perfectly flat week for the DXY basket. Gold was down slightly, and Oil fell to below $63/bbl, a four-month low. The 2-year US bond hit highs not seen since the pandemic collapse in Mar 2020, and given the sharp dip in 10-year paper, the yield curve (US10Y-US02Y) had its worst week for a decade.

The material NFP miss (210k vs 550k) caused the logical reaction, a decline from the open until the last 15 minutes when a few shorts took profit. There was a momentary 'bad delays taper' spike to the upside on the print, so it is hard to say whether Friday's decline was driven by the miss, or the general downward taper acceleration and omicron pressure. The severe underperformance of NDX on Friday suggests the former.

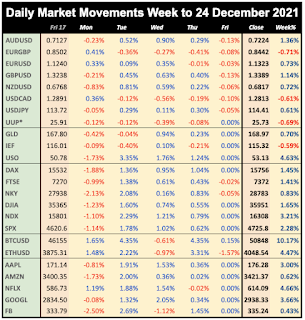

WEEKLY PRICE MOVEMENT

The biggest index mover was NKY, down 2.51%. The top forex mover was AUDJPY this week, down 2.16%. Bitcoin and Ethereum were flat,, and FANGs, except AAPL were particularly weak.

Last week’s NZDJPY short lost 1.55%, taking my year to date profit to 4.35% and 31/47 wins. This week I am convinced it will recover and thus buying NZDJPY again.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

There is only really one important print next week, the US inflation print on Friday. The core estimate of 4.9% is the highest for years and the Fed have said that acceleration of taper program will follow. A much lower figure would move markets strongly, ahead of the FOMC meeting on Dec 15. Chinese and German inflation are also reported. Otherwise Omicron news is likely to dominate, although of course, with markets already over 5% off highs, a lot of both these factors has already been priced in, given the normally buoyant time of year.

CALENDAR (all times are GMT)

Monday December 6

00:00 Aus TD Securities Inflation

07:00 Germany Factory Orders

11:30 BoE Broadbent speech

23:30 Japan Overall Household Spending

Tuesday December 7

00:30 Aus House Price Index

02:00 China Imports/Exports/TB

03:30 RBA Rate Decision/Statement (e0.1% hold)

05:00 Japan Leading Economic Index

07:00 Germany Industrial Production

10:00 Eurozone Q3 GDP (QoQ e2.2% p2.2%)

10:00 Germany ZEW Sentiment

13:30 US Trade Balance

13:30 US Productivity/Labor Costs

13:30 Canada Trade Balance

15:00 Canada Ivey PMI

23:50 Japan Q3 GDP (e0.4% p-0.8%)

Wednesday December 8

10:30 DE10Y Bond Auction (time approx.)

15:00 BoC Rate Decision/Statement (e0.25% hold)

22:00 RBA Governor Lowe speech

Thursday December 9

01:30 China CPI (YoY e2.5% p1.5%)

07:00 Germany Trade Balance

13:30 US Jobless Claims

19:00 BoC Gravelle speech

Friday December 10

07:00 UK GDP

07:00 UK Ind/Mfr Production

07:00 Germany CPI (YoY e6.0% p6.0%)

13:30 US CPI (Core YoY e4.9% p4.6%)

15:00 Michigan CSI (e67 p67.4)

19:00 US Monthly Budget Statement