In this shortened Christmas week, markets dropped hard on Monday on Omicron fears and tighter restrictions including a lockdown in the Netherlands. However, news that omicron, whereas more transmissible is less serious, plus a lack of any bad news and of course the Santa effect drove markets up, with SPX making a closing ATH. Oil was up in line with equities, whereas DXY (and EURUSD) and Gold consolidated with inside weeks. Yields recovered most of last week's drop. Happy Christmas to all my readers.

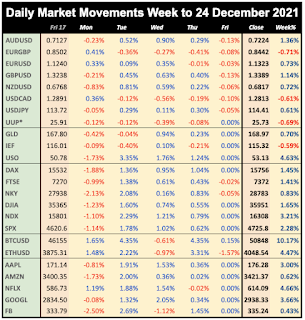

WEEKLY PRICE MOVEMENT

The biggest index mover was NDX, up 3.21%, recovering last week's drop. The top forex mover was AUDJPY up 1.97%. Bitcoin and Ethereum were well up, and FANG outperformed NDX, except for AMZN.

Last week’s USDCAD short made 0.61%, taking my year to date profit to 6.44% and 34/51 wins. This week I will take the NZD catchup trade and short AUDNZD.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

The fact that the biggest releases in the final week of 2021 are housing stats and Chinese PMIs indicates how holidays are in full swing. US Markets are open all week, but volume is expected to be low. Germany is closed on Friday.

CALENDAR (all times are GMT)

Monday December 27

23:30 Japan Jobs/Unemployment

23:50 Japan Industrial Production

Tuesday December 28

14:00 US Housing/Home Price Indices

Wednesday December 29

15:00 US Pending Home Sales

Thursday December 30

13:30 US Jobless Claims

14:45 Chicago PMI

Friday December 31

01:00 NBS Manufacturing PMI

01:00 Non-Manufacturing PMI