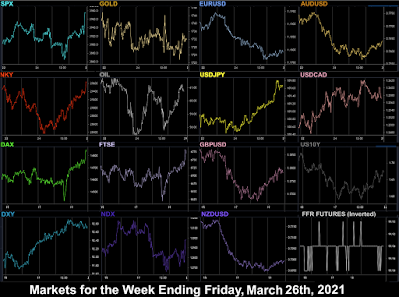

The Powell/Yellen testimony was considered hawkish (by current standards) pushing stocks down and the dollar up. Otherwise, another consolidation week, except for the dollar. Other asset classes either posted a true inside week (US10Y, Gold, DAX) or closed in last week’s range (all indices, Oil). DXY however hit new five-month highs. News-wise, there were few shocks, other than a wild unsustained spike in Gold on Thursday.

Next week sees the end of the month and first quarter, and of course another Non-Farm payrolls, this time with the highest estimate since November. It is Easter week, with four days trading into a four day holiday in many territories. An OPEC meeting on Thursday may break the current Oil consolidation. Other than that, a raft of PMIs, and European inflation (showing Germany breaking apart from the zone as a whole) complete a generally busy week.

Mon Mar 22

Markets rose today although only later in the day after yields had fallen. Slight concern about vaccinations meant COVID-immune NDX outperformed. There is also a notable correlation between bonds and NDX. The dollar continued the rally it started last week, pushing currencies and Gold down. Oil tends to run with industrials, as with DJI the weakest index today, it fell very slightly. Bonds were up.

Tuesday March 23

TreasSec Yellen’s hawkish assessment today, where she expected the US to return to full employment in 2022, which of course indicates an unwinding of QE. Stocks fell, NDX less so, as it is less affected by this. The dollar of course liked it, and was sharply up, meaning Gold, Oil and yields fell both in line with the dollar and equities.

Wednesday March 24

Upbeat PMI data pushed up traditional value stocks today, at the expense of tech, with energy stocks (and Oil) both up on the Suez Canal closure. Simple supply and demand. Less of the former, latter is constant. However everything fell again into the close after another day’s testimony from Powell and Yellen. The dollar continued upwards, and Gold was down in line. Bonds were up for a third day.

Thursday March 25

A weak auction of 7-year paper caused a reversal back down in bonds today. The equity market was up (SPX +0.52%) but again NDX notably underperformed (-0.14%). The dollar rallied for a third day, hitting a five-month high after two weeks of consolidation, pushing Gold and Oil down. When equities are only mildly positive, and the dollar moves strongly, Oil reflects the latter.

Friday March 26

The day was positive, but most of the rally was in the last hour, putting the indices in positive territory for the week. The dollar reversed after three strong days, and this was reflected in Gold and Oil, the latter being assisted by the Suez issue. Bonds were down in line with the equity rally.

WEEKLY PRICE MOVEMENT

Yet another consolidating week for all assets except the dollar. The top index mover was NKY, down 2.07% although 0.63% of this can be attributed to JPY’s move. The top forex mover was NZDUSD down 2.08%. Crypto pulled back slightly, and FANGs slightly underperformed NDX.

I wish I’d stuck with JPY for a third week, but my short of GBPUSD was up 0.57%. Total to date -1.78%, with 7/12 win. This week I think the NZD drop is overdone, and will sell EURNZD

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

Next week sees the end of the month and first quarter, and of course another Non-Farm payrolls, this time with the highest estimate since November. An OPEC meeting on Thursday may break the current Oil consolidation. Other than that, a raft of PMIs, and European inflation (showing Germany breaking apart from the zone as a whole) complete a generally busy week.

NEXT WEEK (all times are GMT)

(Calendar High volatility items are in bold)

- Four day Easter week

- Non-Farm Payrolls

- UK and Germany inflation

- OPEC and PMIs

Monday March 29

FTSE Russell should confirm that Chinese government bonds are included in their World Index today. If so, this is bullish for an already extended CNY.

23:30 Japan Jobs/Unemployment

23:50 Japan Retail Sales

Tuesday March 30

Two Fed speakers today, as we move into the close of the quarter.

09:00 Eurozone Consumer Confidence/Business Climate

12:00 Germany CPI (e2.0% p1.6%)

13:00 US Housing/Home Price Indices

13:00 Fed Quarles speech

14:00 US Consumer Confidence(Mar)

18:30 Fed Williams speech

23:50 Japan Industrial Production

Wednesday March 31

The final day of Q1 sees a speech from President Biden. There is a rate decision in Colombia. There is plenty of news, so expect EOQ volatility.

00:30 Aus Building Permits

01:00 China PMIs (Mfr e51.0 p50.6)

06:00 UK Q4 Final GDP (e1.0% prelim1.0%)

07:55 Germany Unemployment Rate/Change

09:00 Eurozone CPI (YoY e0.9% p0.9%)

12:15 US ADP Employment Change (e550k p117k)

12:30 Canada Q4 GDP (MoM)

13:45 Chicago PMI

14:00 US Pending Home Sales

21:30 Aus AiG Performance of Mfg Index

23:50 Tankan Large Manufacturing Index (e0 p-10)

Thursday April 1

The new month and quarter being. There is an OPEC meeting today, and production cuts are expected to be maintained. Look out for any news on the Ever Given, which has effectively closed the Suez Canal. Norway and Denmark are closed for Maundy Thursday.

00:30 Aus Imports/Exports/TB (TB e9.5B p1.01B)

00:30 Aus Retail Sales (e-1.1%, p-1.1%)

01:45 Caixin Mfr PMI

06:00 Germany Retail Sales (e1.3% p-8.7%)

07:55 Germany Markit Mfr PMI

08:00 Eurozone Economic Bulletin

08:30 UK Markit Mfr PMI

12:30 US Jobless Claims

13:30 Canada Markit Mfr PMI

13:45 US Markit Mfr PMI

14:00 US ISM Mfr PMI (e61.2 p60.8)

Friday April 2

Markets are closed in most countries including the US and all of Europe for Good Friday. Markets will be closed for four days (Easter Monday) in many countries. Today is NFP, with the highest jobs estimate since November.

12:30 US NFP/AHE/UnEmp (NFP e655k p379k)