Earnings season falters slightly, Surprise BoC QE cut and hike hint, Biden CGT hike shocks traders

MY CALL THIS WEEK : SELL AUDUSD

This week saw an early two-day 1.2% pullback on the continuing rise in COVID-19 in emerging market countries, particularly India, and overall global deaths reaching the psychological 3M level. US companies are active everywhere in the world, and so vaccine and re-opening progress at home is not the whole story. For many companies, recovery and consequent fiscal tightening at home, coupled with depressed international markets is a lose-lose situation. India, a country with four times the population of the US is particularly hard hit with a third wave.

News of the Biden capital gains tax hikes on Thursday, which will particularly hit the trading community, caused an instant 1% drop in US equities. NFLX failed to meet subscriber estimates and fell 7.5%. Nevertheless, and even despite a slight uptick in volume, the week was generally a V-shaped consolidation, even briefly eking out a new SPX intraday high on Friday. FTSE, DJIA and yields posted inside weeks, and most other instruments ended with extremely small candle bodies.

Next week sees an important Fed meeting, with a strong vaccine rollout, and re-openings continuing, with there be any hint of QE taper, or even more extreme, a rate hike. Also we see companies comprising over 40% of NDX reporting, which could have a noticeable effect on the DJI/NDX ratio. These two factor will undoubtedly overshadow most other data, except perhaps PCE, the Fed’s preferred method of inflation measurement.

Given that there is a slight risk of a hike, the ‘dovish message’ bar is set fairly low this month, and traditionally, there is one more week before the traditional seasonal selloff.

Mon Apr 19

The coronavirus death toll passed a symbolic three million at weekend, and markets fell today, with NDX underperforming. The SPX drop of 0.53% was the worst for a month, and NDX fell 0.96%. As developing nations suffer a larger third wave, international company sales suffer, whereas fiscal policy is led by the US recovery. The dollar also fell to a six-week low. Surprisingly Gold also fell, and Oil rose slightly.

Tue Apr 20

Market did their second red day in a row for the first time since late March today, after only mild beats on major earnings and a downbeat ECB Bank Lending survey. A textbook risk-off day, with NDX underperforming and Gold, bonds and the safe-haven dollar up, and Oil down. The theme was continued after the bell with NFLX falling 7% on lacklustre new subscriber numbers.

Wednesday April 21

After a two-day 1.2% pullback, market snapped back today with RUT leading the way, up 2%. NDX underperformed, and Gold rose 1% and Oil dropped again, so it was only a reaction to the earlier part of the week, rather than a change in mood. The dollar would have risen except for a 1.46% appreciation in an hour in CAD, after the BoC announced something unheard of at the moment, a reduction in QE (although this was only correcting a large drop on Tuesday). Bond yields were flat on the day.

Thursday April 22

As markets were starting to recover, the news of President Biden’s potential doubling of capital gains tax to 40% for millionaires hit the mood of traders (the ones who would pay it) hard. SPX dropped 1% instantly and stayed down until the close. The news came after Europe closed, leaving DAX and FTSE green. The safe-haven dollar rose, and this time Gold fell and Oil rose, following the dollar. Bonds were once again flat.

Friday April 23

Today, markets realised that values are not linked to traders’ tax bills. The 1% drop was recovered in the morning session, and SPX briefly touched a new high of 4196.20. NDX outperformed. USD reversed back down as did Gold and Bonds. Oil was up, so all in line, just like Tuesday in reverse.

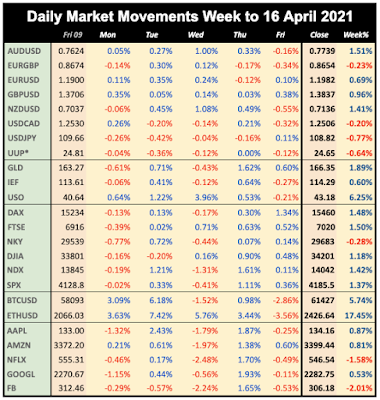

WEEKLY PRICE MOVEMENT

Markets down this week, with NKY showing the biggest loss. The top mover was EURAUD up 0.98%. BTC fell sharply by $10,000 although ETC did not. FANGS were flat, pre-earnings, except of course NFLX.

My strategy of reversing the most extreme pair worked for a third week, but only by a lousy 0.01%, taking the total to -0.79%, 11/15 wins. I will try the same pair for another week, selling AUDUSD.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK (all times are GMT)

(Calendar High volatility items are in bold)

- Key NDX earnings week

- FOMC Rate Set meeting

- Rate decisions in Japan and Sweden

- End of month before May

Monday April 26

The final week before ‘Sell in May’ starts, so watch out all week for front-running given that SPX is at all time highs. Not much during the daytime, but cult stock TSLA (4.35% of NDX) reports after the bell. Markets are closed in Australia for ANZAC day observed.

05:00 Japan Leading Economic Index(Feb)

08:00 German IFO Business Sentiment

12:00 ECB Panetta speech

12:30 US Durable/ND Capital Goods (Durable e2.5% p-1.2%)

13:00 ECB Lane speech

Tuesday April 27

Key earnings today after the bell are NDX giants MSFT and GOOGL (together 13.64% of NDX). As well as Japan, there are rate decisions in Sweden and Hungary today. SEK is 4.2% of the DXY basket. Markets are closed in South Africa and The Netherlands.

05:00 BoJ Rate Decision/Statement (e-0.1% p-0.1%)

08:00 BoJ Press Conference

15:00 US Housing/Home Price Indices

16:00 US Consumer Confidence(Apr)

22:00 BoC Macklem speech

23:50 Japan Retail Sales

Wednesday April 28

Today is FOMC day, and for the first time in months, a hold is not 100% priced in, there is a 2.8% chance of a hike, according to the CME FedWatch tool. Traders will be looking for any hint of QE taper, now the vaccine program is well established. The largest company in the world AAPL reports after the bell, along with FB make up 14.9% of NDX. So a big day, near the end.

01:30 Australia CPI (RBA Trimmed Mean QoQ e0.5% p0.4%)

06:00 Germany Gfk Consumer Confidence Survey(May)

10:00 OPEC Meeting

12:30 Canada Retail Sales (e-3%, p-1.1%)

14:00 ECB President Lagarde speech

18:00 Fed Rate Decision/Statement (e0.25% hold)

18:30 FOMC Press Conference

Thursday April 29

A lot of data, but most of it low-level. Markets are more likely to be influenced by the Fed and AAPL. Today it is the turn of AMZN (8.47% of NDX) to report after the bell. There is a rate decision in Egypt. Markets are closed in Japan for Showa Day.

07:30 ECB De Guindos speech

07:55 Germany UnEmp Rate/Change

08:00 Eurozone Economic Bulletin

09:00 Eurozone Consumer Confidence/Business Climate

11:30 ECB Weidmann speech

12:00 Germany CPI (e2% p2%)

12:30 US PCE QoQ

12:30 US Jobless Claims

12:30 US Q1 GDP Prelim (e6.5% p4.3%)

14:00 US Pending Home Sales (MoM)(Mar)

18:00 Fed Williams speech

23:30 Tokyo CPI

23:30 Japan Jobs to Applicants/Unemployment

23:50 Japan Industrial Production

Friday April 30

Oil earnings today, with the two halves of Rockefeller’s empire CVX and XOM reporting, along with PSX. XOM left the Dow last year, despite once being the biggest company in the world. There may be end of month volatility, including front running a May sell-off. There is a rate decision in Colombia. Markets are closed in Greece and Romania for Orthodox Good Friday, and Denmark.

01:00 China NBS PMIs (Mfr e51.4 p51.9)

06:00 Germany Q1 GDP Prelim (p0.3%)

09:00 Eurozone CPI (Core e0.9% p0.9%)

09:00 Eurozone Q1 GDP (QoQ e-0.8% p-0.7%)

09:00 Eurozone Unemployment Rate(Mar)

12:30 US PCE MoM/YoY

12:30 US GDP MoM

13:45 Chicago PMI

14:00 Michigan CSI