A strong opening to earnings season, and equally strong macro data meant we saw indices once again rose making new all-time highs, including NDX breaching 14,000 for the first time. 4-week jobless claims were the lowest since the pandemic started. All sectors moved together, the tech outperformance this week was only marginal. Despite rising currencies, DAX and FTSE performed well, the former making another all-time high and the latter crossing 7,000, finally above its Feb 20 high. However, volumes have been declining in this rally since March, and trend, although clear, was only modest, and notably FANG underperformed NDX, which it self made no appreciable gain against SPX. The rally looks fragile.

The dollar declined for a second week, pushing up all currencies and Gold. The inflation print beat, causing a move into bonds, but unlike Retail Sales was not a blowout (CPI Core 1.6% vs 1.5% est) and crucially still below the Fed target, meaning equities were not affected (by a fear of early taper).

In equities, next week is dominated by earnings, with bellwether IBM, FANG giant NFLX, and Dow heavyweights JNJ, PG, AXP and TRV. On the currency front, we have the BoC facing a loonie at three-year USD highs, and more importantly, the ECB in their eternal quest to stimulate inflation without appearing hawkish. There are, however, no significant US macro prints until Thursday.

Mon Apr 12

SPX was flat today, and DJI and NDX pulled back very slightly, as markets stabilised the large run-up on Friday afternoon. The dollar continued its decline, although not against. Unusually therefore, Gold was slightly down, and Oil was slightly up. Bonds were flat on the day.

Tuesday April 13

Markets keep going up, but the COVID situation seems to determine which sector. Today’s concern that the JNJ vaccine (the stock gapped down 2.93%, MRNA gapped up 5.29%) caused blood clots meant NDX added 1.21% and DJI fell slightly. The dollar fell more sharply today, and bonds and Gold were up both on the underlying COVID risk-off and the dollar. Oil was up slightly.

Wednesday April 14

Today saw earnings blowouts from JPM and GS (both DJIA components) pushing DJIA into positive territory while NDX fell 1.31%. Bonds were down in line, part of a slower trend of yields rising in expectation of inflation. A third down day for the dollar, but Gold fell as well, follow equities for a change. Oil was up, also in line with equities.

Thursday April 15

A second day of positive earnings, and strong beats in Retail Sales and Jobless Claims sent markets even higher, SPX was up 1.11% and NDX 1.61%. The macro prints also arrested the dollar decline which had a flat day, allowing Gold to rise. Oil was up in line, and once again so were bonds, yields reacting to the falling dollar rather than equities.

Friday April 16

A fifth day and no change in trend. FTSE crossed 7,000 and also made a new all-time high, the first since Feb 2020. Other indices made all-time highs as they had been doing all week. The dollar carried on down again, pushing Gold up and Bonds down. Oil slipped slightly. The week had a clear pattern, stocks, gold, bonds and Oil up, dollar down.

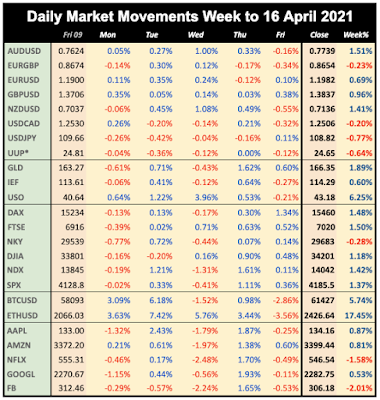

WEEKLY PRICE MOVEMENT

The moves were up but slight, with all indices making similar gain, FTSE doing best up 1.50%. The top forex mover was AUDUSD up 1.51%. Another week of flat Bitcoin and ramping Ethereum. FANGs, for once, underperformed NDX as a whole.

My strategy of reversing the most extreme pair worked for a second week, EURGBP fell by 0.23%, taking the total to -0.80%, 10/14 wins. I will try it again for a third week, selling AUDUSD.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK (all times are GMT)

(Calendar High volatility items are in bold)

- Earnings season continues

- ECB Rate Decision

- BoC Inflation and Rate Decision

- No US macro news until Thursday

Monday April 19

Earnings today include Dow staple KO before the bell, and bellwether IBM after the close. As is often the case on Mondays, there is no significant European or US macro data.

23:50 Japan Imports/Exports/TB (Sun)

04:30 Japan Industrial Production

Tuesday April 20

If we add in the previous nights IBM to Dow components JNJ, PG and TRV reporting before the bell, we have a total of 11.33% of DJIA reporting between sessions. Each 1% move in these stocks is 39 points in the index. In addition NFLX report after the bell. In previous earnings, the market sold off if subscriptions were not up to estimates, even if EPS and Revenue beat.

01:30 PBoC Rate Decision/Statement (e3.85% hold)

01:30 RBA Meeting Minutes

06:00 UK Claimant Count/AHE/UnEmp (UE e 5.2% p5.0%)

08:00 ECB Bank Lending Survey

Wednesday April 21

Todays focus is on Canada with inflation and a rate decision. With CAD at three-year highs, any surprises could have a strong effect. There are no significant earnings releases.

00:30 Aus Westpac Leading Index

01:30 Aus Retail Sales prelim SA (MoM e0.8% p-0.8%)

06:00 UK CPI/RPI/PPI (CPI YoY e0.7% p0.4%)

08:05 BoE Ramsden speech

10:00 DE10Y Bond Auction (time approx.)

10:30 BoE Governor Bailey speech

12:30 BoC CPI (Core YoY p1.2%)

14:00 BoC Rate Decision/Statement

15:15 BoC Press Conference

Thursday April 22

The main news of the day is the ECB rate decision, or more specifically, have eschewed negative rates in the past, any alterations to loosening policy. The first two US significant macro prints of the week are at 1230. NDX giant INTC reports after the bell.

01:30 Aus NAB Business Confidence

11:45 ECB Rate Decision/Statement (e0% hold)

12:30 US Jobless Claims

12:30 Chicago Fed National Activity Index

12:30 ECB Pres Lagarde Presser

14:00 Eurozone Consumer Confidence

23:00 Aus Commonwealth Bank PMIs

23:30 Japan National CPI

Friday April 23

The week closes with a raft of PMIs. DJIA component AXP reports before the bell.

06:00 UK Retail Sales

07:30 Germany Markit PMIs (Mfr e65.9 p66.6)

08:00 Eurozone Markit PMIs (Comp e52.8 p53.2)

08:30 UK Markit PMIs (Services p56.3)

13:45 US Markit PMIs

14:00 US New Home Sales (MoM)(Mar)

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.