In a week that saw nothing surprising in the news, ie no changes in the stimulus plan, the vaccine rollout or The Fed’s stance, as expounded in the Humphrey-Hawkins testimony from Chair Powell, we got a chance to see underlying sentiment.

It is easy to believe the market is bullish, as Gold, bonds and JPY made new five-month lows this week. However, there was a clear underperformance in NDX this week, which never improved on its opening gap down and DJI which actually made new highs. The danger is that the pullbacks in the last couple of weeks may mean investors are moving to cash, perhaps expecting a ’no hiding place’ pullback, a general collapse in sentiment across all asset classes, reminiscent of March 20, and unlike Q4/18, where conventional havens were available. It does of course also mean with uninvested cash, the recovery from the correction will be swift. The problem with trying to interpret haven assets in March 20 is that equities fell first.

This week saw USD move up suddenly, but not buy much and well within the 89.20-91.60 (2.7%) range it has run all year. Note that moves to dollar cash from dollar instruments (such as ETFs), the majority of transactions, do not of course affect the dollar itself. The V-shaped (or inverted) charts for the currency and foreign indices confirm this consolidation.

Mon Feb 22

Markets fell today, as the pullback continued. The general feeling was that this is the start of a correction after the election to January rally, and NDX fell further than SPX, although FANG, in general didn’t fall as far as NDX in general. USD was down across the board meaning Gold was up 1.50%. The equity pullback did not affect Oil which continued this week’s rally making a new 13-month closing high. Unusually, bonds were also slightly up on the day.

Tue Feb 23

Today was a wild ride, with NDX down as much as 3.9% at one point, before recovering most of the drop. SPX followed a similar path and ended 0.13% up. All part of a correction. The dollar was surprisingly quiet, flat with little volatility. Gold was similarly flat. Bonds were up and Oil was down in line with risk-off mood.

Wednesday February 24

Chair Powell today reiterated his dovish stance in the Humphrey-Hawkins testimony, and markets rose late in the day after falling at the open. Bonds followed stocks inversely, ie the yield chart looks much like the SPX chart. The dollar was flat overall, but this was composed of a general upward dollar (hence Gold down) but a notable strong rise in JPY, showing the markets are far from risk-on. Oil continued its rise.

Thursday February 25

The general mood we have seen all week and elevated prices trigged a sharp fall today with SPX down 2.5% and NDX losing 3.5% its worst day since October. The bond market also sold off with yields hitting a new 12m high of 1.6140%, in fact almost synchronously with equities, so not a flight from risk to fixed income, a flight to cash, as Gold also fell, and even Oil was only flat.

Friday February 26

There was some recovery today from yesterday’s sharp sell-off, with bond yields down 10bp and NDX up 0.6%, although DJIA and SPX were down. Much more action on USD which was sharply up following a sharp reverse in bond yields, down 10bp on the day. Gold was sharply down on the rising dollar, and Oil pulled back on the weaker equity position.

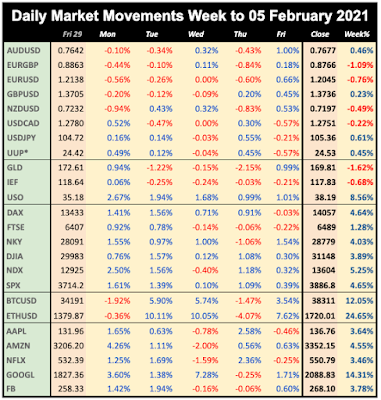

WEEKLY PRICE MOVEMENT

A second week of pullback, with NDX the biggest loser, down 4.94%. The largest forex mover was AUDUSD down 2.09% Cryptos continued to fall sharply after their super-rally, and FANGs broadly followed NDX down.

I was.a week too early last week with my AUDUSD sell. I made 0.34% on my EURGBP taking my total this year to a measly 0.58% with 6/8 wins. I will learn from my AUD mistake, and buy EURGBP again.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK (all times are GMT)

(Calendar High volatility items are in bold)

- New Month

- Trend is down

- RBA Rate Decision

- Canada, Australia GDP

Mon Mar 1

A new month with five Markit Manufacturing PMIs, speeches from Fed Williams and Brainard, and ECB De Guindos, and President Lagarde at 1610, although this is only a pre-recorded event for German SMEs.

00:00 Aus TD Securities Inflation

01:45 China Caixin Mfr PMI(Feb)

08:55 Germany Markit Mfr PMI(Feb)

09:30 UK Markit Mfr PMI(Feb)

13:00 Germany CPI (e1.6% p1.6%)

13:30 Canada Current Account(Q4)

14:30 Canada Markit Mfr PMI(Feb)

14:45 US Markit Mfr PMI(Feb)

15:00 ISM Mfr PMI (e58.9 p58.7)

23:30 Japan Jobs/Unemployment Rate(Jan)

Tue Mar 2

Another heavy data day, and CB speeches from ECB Panetta and Fed Brainard again.

03:30 RBA Rate Decision/Statement (e0.1% hold)

07:00 Germany Retail Sales (YoY e5.0% p1.5%)

08:55 Germany Unemployment Rate/Change(Jan)

10:00 Eurozone CPI (Core YoY e1.1% p1.4%)

13:30 Canada Q4 GDP Final (QoQ e47.6% p40.5%)

22:00 Aus Commonwealth Bank Svcs PMI(Feb)

Wednesday March 3

The data keeps on coming. Four ECB speeches today: Weidmann, Panetta, De Guindos and Schabel.

00:30 Australia Q4 GDP Final (QoQ e2.5% p3.3%)

01:45 China Caixin Svcs PMI(Feb)

08:55 Germany Markit PMI Composite(Feb)

09:00 Eurozone Markit PMI Composite(Feb)

13:15 US ADP Employment Change (e168k p174k)

14:45 US Markit Svcs PMI(Feb)

14:45 US Markit PMI Composite(Feb)

15:00 ISM Svcs PMI (e58.7 p58.7)

19:00 Fed Beige Book

Thursday March 4

Key today is the US Initial and Continuing Jobless Claims. Chair Powell speaks at the Wall Street Journal Jobs Summit.

00:30 Aus Imports/Exports/TB (TB e6.5B, p6.78B)

00:30 Aus Retail Sales (MoM e0.6%, p0.6%)

09:00 Eurozone Economic Bulletin

10:00 Eurozone Retail Sales (YoY e-1.3%, p0.6%)

10:00 Eurozone Unemployment Rate(Jan)

13:30 US Jobless Claims

15:00 US Factory Orders (MoM)(Jan)

17:05 Fed Chair Powell speech

Friday March 5

First Friday so it’s NFP day with little else on the calendar.

07:00 Germany Factory Orders s.a. (MoM)(Jan)

13:30 US NFP/AHE/UnEmp (NFP e148k p49k)

13:30 US Trade Balance(Jan)

15:00 Canada Ivey PMI