In a week which saw the vaccine rollout continue without a hitch, the collapse of the small trader inspired shot squeeze on GME, and a new Jobless Claims low, equity markets soared to new highs posting the best week since the election, with Oil rising in line and finally, Gold, Bonds and JPY smoothly fading in the risk-on environment. The dollar relinquished its safe haven status, and finally broke out to the doldrums to the upside, and we saw the first hint for months of hawkishness with the BoE dismissing for now the idea of negative rates.

Next week sees the start of the Chinese Year of the Ox, or Bull. Do not underestimate the sentimental value of this in China. There is a pause in earnings season before the retail phase, with only KO and DIS of note reporting. Otherwise, the calendar is light, with only inflation (US, China, Germany) on Wednesday of any significance.

Mon Feb 1

After last week’s pullback, markets recovered today on continued vaccine progress, and some bipartisan support for the stimulus package, and shrugged off the ISM PMI miss. SPX added 1.6% and risk-sensitive NDX outperformed. There may have been some rebuying for the new month. Oil was up in line. The VIX, however, stayed above 30, however, driven by the r/WallStreetBet saga, as GME fell 30%. Having sat in the 90-91 range for weeks, the dollar finally broke out and hit a 7-week high in a fairly even move against all currencies. Paradoxically, Gold ignored both equities and dollar and added nearly 1%. It does this sometimes, clearly bid all day. Bonds were flat on the day.

Tuesday February 2

A second day of rally for the same reasons, and with GME falling a further 60%, an institutional relief sentiment that ‘the mob’ cannot, in fact, break institutional positioning. Small investors collectively lost billions in this GME escapade, and the bulletin boards went quiet. Again Oil was up in line, but this time Gold pulled back as expected, and bonds were down, reflecting the risk-on mood. The dollar was flat on the day except against the antipodeans, which are not part of DXY, both 0.32% up on the RBA stimulus.

Wednesday February 3

News of our old friend Mario Draghi as the new Italian Prime Minister caused a lift in MIB and BTPs, but had little effect on the rest of the world, and SPX took a breather today, with very little volatility, and only slightly up. NDX underperformed and posted a red candle, despite a 7.3% rise in GOOGL after earnings the evening before. Similarly the dollar was quieter, moving less than 0.1% against any of the basket currencies. Gold and bonds were slightly down, but Oil was up for a third straight day.

Thursday February 4

Another day and the rally resumed, with indices posting new all-time highs, after the lowest Initial Jobless Claims since November. Oil was up, and all indices were positive except FTSE, after GBP shot up 1% in two hours after the BoE confirmed that there would be no negative interest rates anytime soon. UK yields rose on the news. Otherwise it was a strong day again for the dollar, which made a new 7-week high, pushing Gold down. Bonds were flat.

Friday February 5

The rally continued again today closing the best week since November. Also, after fully retracing, shares in GME rallied again by nearly 20% after Robinhood removed trading restrictions. After rallying all week the dollar came off sharply after the NFP miss and back into the consolidation range. Gold was up in line with the dollar move, and Oil and yields were up in line with equities.

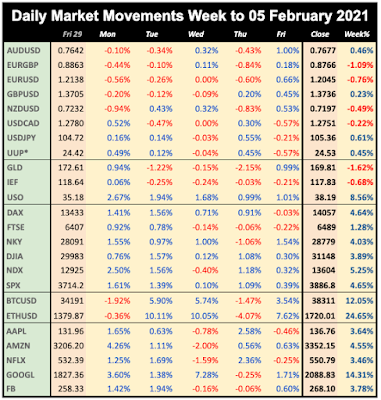

WEEKLY PRICE MOVEMENT

The best week since October saw all indices rise, with risk-on index NDX marginally the best performer. EURAUD was the biggest forex mover, down 1.22%. Cryptos rallied hard with ETH hitting a new ATH. FANGs performed in line with NDX, except for GOOGL up a massive 14.31% also making a new ATH.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK (all times are GMT)

(Calendar High volatility items are in bold)

- Chinese New Year

- Earnings Season Pause

- China, Germany, US inflation

- Thin US macro news

Monday February 8

As is often the case, a quiet Monday.

23:50 Japan Current Account (Sunday)

07:00 Germany Industrial Production

Tuesday February 9

Another day with no significant US news. Tech firms TWTR and CSCO report after the bell.

02:00 China Imports/Exports/TB

07:00 Germany TB

23:30 Aus Westpac Consumer Confidence

Wednesday February 10

The main news day of the week, with Chinese, German and US inflation. Dow staple KO reports before the bell. There is a rate decision in Sweden (SEK is 4.2% of DXY).

00:00 Aus HIA New Home Sales

01:30 China CPI (YoY p0.2%)

07:00 Germany CPI (YoY p1.6%)

13:30 US CPI (YoY e1.6% p1.6%)

16:30 BoC Lane speech

17:00 BoE Governor Bailey speech

19:00 US Monthly Budget Statement

Thursday February 11

Entertainment giant DIS report before the bell, with only a single significant news items. There are rate decisions in the Philippines and Mexico. Markets are closed today in China and remain closed until next Thursday, as the new Year of the Ox…or Bull. Hong Kong reopens on Tuesday. Markets are also closed in Japan for one day.

13:30 US Jobless Claims

Friday February 12

Focus is on the UK today with second GDP reading. There is a rate decision in Russia.

07:00 UK Manufacturing/Industrial Production

07:00 UK Prelim Q4 GDP (e15.8% p16%)

10:00 Eurozone Industrial Production

15:00 Michigan Prelim CSI (p79)

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.