Earnings season opens, Shift out of tech, Gently declining dollar

MY CALL THIS WEEK : SELL GBPCAD

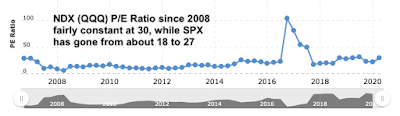

This week saw positive news, both on the vaccine front, and in comments from Fed Governor Brainard (admittedly a known dove) suggest even further stimulus. However, the COVID cases keep rising, and the net result was a fairly flat week with SPX attempting and failing to break 3235 twice, and NDX down. The pullback in the tech/industrial ratio is the most noticeable feature of this week’s market, and it was accelerated by NFLX missing on earnings, against beats by JPM, C and GS, the latter very strongly. The ratio has recently overshot the 2000 bubble level, had to happen at some point, although there is no reason it cannot go higher, as the NDX/SPX PE differential is nowhere near 2000 levels, indeed if anything it has fallen.

The ECB said nothing news, and the dollar chart was extremely similar to last week, slow and slight classic waves to the downside, and bonds and Gold were in consolidation at their current elevated level. JPY also consolidated and posted a flat week, as did Oil.

Next week sees more of earnings season, with the main event being MSFT and TSLA reporting late on Wednesday. The fact that Canadian inflation and a PMI batch on Friday are the main events tells you how light the week is. Earnings and COVID news should therefore set the tone.

Mon Jul 13

After rallying earlier in the day on vaccine hopes from BNTX (up 20%) and DJIA stock PFE, markets sold off sharply in the US afternoon session, possibly on news of a new closedown in California, but also a rejection of the previous post-COVID high of 3235 from Jun 8th. Oil fell in line. Gold and bonds were up, but not JPY which was down, despite a general flat dollar (the JPY move was matched by a GBP fade).

Tuesday July 14

Indices rebounded with DJIA outperforming NDX, as JPM and C beat estimates. But banks themselves were not in favour, it was the archetypal industrial CAT that was the best mega-cap performer, up 4.83%. The dollar fell some more, down across the board, and yields and Oil were up in line, although Gold was up slightly.

Wednesday July 15

Markets were up again today after a strong earnings beat by GS, more positive vaccine news from MRNA (up 7% and 16% at one point), There was a call by Fed Brainard for more stimulus, although Lael Brainard is a known dove, this was still a positive mover. Once again there was strong divergence against tech, with NDX only up 0.11%. Oil was up in line. Gold and Bonds were flat, and the dollar once again fell across the board.

Thursday July 16

We had a reversal today after a sharp pullback in the China 300 index (4.75% its worst day since February), and a miss in the Initial Jobless Claims figure, but also linked to the 3235 post-COVID high, which was reached on Jun 8, and again yesterday. Despite earnings beats from JNJ and BAC, SPX was down 0.34%, and for a fourth day NDX underperformed, down 0.70%. NFLX missed on earnings after the bell, was was down 10% in after-hours trading, although the stock is not heavily weighted on NDX, so the index move was modest.

And for a fourth day, yields and Oil were up in line, and Gold wasn’t! The dollar also bounced back up (evenly across all currencies), meaning for a fourth day, the yen did not move inversely to indices. This is interesting in a rare week where industrials outperform tech, perhaps those industrials can be seen as the safe haven.

Friday July 17

In the absence of significant earnings releases, the final day of the week was fairly flat, but again with SPX outperforming NDX. Both indices failed to advance even 1%, and DJIA posted a red candle. Haven assets were mixed, with JPY and Gold up, but bonds slipping slightly. The dollar gave up Thursday’s gains, and Oil was slightly down. A directionless day to end a fairly directionless week, as seen in the total flat Fed Funds Rate chart. The only major trend was the shift away from tech.

WEEKLY PRICE MOVEMENT

Europe outperformed this week, with DAX the strongest index. The top forex mover was EURGBP up 1.68%. Cryptos continued to stay flat, BTC now only moves like any currency, and FANGS noticeably underperformed, even more so than NDX as a whole. with NFLX and AMZN (the two with sky-high P/E ratios) hit the hardest.

A better week for my forex call. I managed to pick the best mover EURGBP, adding the 1.68% to my running total gives gains of 7.16% (24wks 11 wins). This week, the picture is not much clearer, but CAD looks the strongest and GBP the weakest, so I will sell GBPCAD.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK (all times are GMT)

(Calendar High volatility items are in bold)

- Second week of earnings

- Emphasis on tech

- Canada inflation

- PMIs on Friday

Monday July 20

As is often the case, news is light today. Traditional DJIA bellwether IBM (although less so these days) reports after the bell. Markets are closed in Colombia.

23:50 BoJ MPC Minutes (Sun)

23:50 Japan Imports/Exports/TB

01:30 PBoC Interest Rate Decision (e3.85% hold)

06:00 Germany PPI

15:10 BoE Haldane speech

15:10 BoE Tenreyro speech

23:30 Japan National CPI

Tuesday July 21

Again, little scheduled news in this holiday season. DJIA heavyweight KO reports before the bell.

01:30 RBA Meeting Minutes

02:30 RBA Governor Lowe speech

08:30 UK PSBR

12:30 Chicago Fed National Activity Index (Jun)

12:30 Canada Retail Sales (MoM May e21% p19.1%)

Wednesday July 22

A third day of uneventful news, means the key event comes after the bell, with NDX stalwart and 11.1% weight MSFT and recent market darling TSLA (now no 7 and 2.58% weight) reporting. TSLAs recent price moves have been quite amazing, rising 320% in four months.

00:30 Aus Westpac Leading Index (MoM)(Jun)

01:30 Australia Retail Sales

12:30 Canada CPI (BoC Core YoY e0.9% p0.7%)

13:00 US Housing Price Index (MoM)(May)

14:00 US Existing Home Sales (MoM)(Jun)

Thursday July 23

Jobless Claims is the first important US macro print in this quiet week, and another large NDX component (no 8 by weight) INTC reports after the bell. Markets are closed in Japan for Marine Day.

01:30 Aus NAB Business Confidence

06:00 Germany Gfk Consumer Confidence Survey(Aug)

11:00 BoE Haskel speech

12:30 US Jobless Claims

22:45 NZ Imports/Exports/TB (Jun)

23:00 Aus Commonwealth Bank Mfr PMI

Friday July 24

The Eurozone and German PMIs are expected to cross 50 today, the line between expansion and contraction. The US is already there of course. AXP reports before the bell. Markets are closed in Japan for Sports Day, which would have been the date of the Olympic opening.

06:00 UK Retail Sales

07:30 Germany Markit Mfr Prel PMI (e48.3 p45.2)

07:30 Germany Markit Composite Prel PMI (e50.3 p47.0)

07:30 Eurozone Markit Composite Prel PMI (e51.1 p48.5)

08:30 UK Markit Services Prel PMI (e51.0 p47.1)

13:45 US Markit PMIs

14:00 US New Home Sales

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.