New multi-year highs for USDJPY and yields. Tech recovers.

MY CALL THIS WEEK : SELL AUDJPY

LAST WEEK

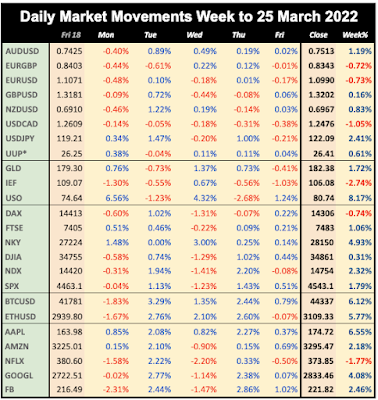

With a stalemate in Ukraine, this week’s moves were much more muted, although US indices made post-invasion highs, although DAX did not, despite the EU PMI beats, although European consumer confidence dropped by the second largest amount on record. The dollar (DXY) had an inside week, as did the euro and Gold. The yen continued to fall with USDJPY making highs not seen since Dec 2015. AUDJPY hit highs last seen in August 2015, and both AUD and NZD made new 2021 highs against the dollar. Yields broke 2.4%, a new three year high, after Fed Powell's remarks preparing markets for 50bp increases. Oil continued to consolidate after the high two weeks ago, still managed to post an 8% weekly gain, such is the current volatility.

WEEKLY PRICE MOVEMENT

The biggest index mover was oversold NKY, up 4.93%. The top forex mover was again AUDJPY up 3.59%. The pair has risen 6.93% in two weeks. Bitcoin and Ethereum rallied again although less than last week. Tech outperformed again with all FANGs except NFLX up in line.

\

Last week's EURCAD long position lost 1.48%, which means I am ahead 4.08% this year, with 6/11 (54.5%) wins. This week I am banking on AUDJPY reversing and shorting it.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

A new month and quarter, so the main event is NFP on Friday. Give the Ukrainian stalemate, this event may have more significance than last month. Fed Williams speaks this week, and traders will be alert to rate hike clues before earnings takes over next week. Germany and the Eurozone report inflation this week, both estimating a small increase. We also have US GDP (equal to inflation so zero real growth), and also UK GDP (well below inflation).

CALENDAR (all times are GMT, volatile items in bold)

Monday March 28

11:00 BoE Governor Bailey speech

23:30 Japan Jobs/UnEmp

Tuesday March 29

00:30 Aus Retail Sales

06:00 Germany Gfk Consumer Confidence

13:00 Fed Williams speech

13:00 Housing/Home Price Indices

23:50 Japan Retail Sales

Wednesday March 30

08:10 BoE Broadbent speech

09:00 Eurozone Business Climate/Consumer Confidence

12:00 Germany CPI (e5.4% p5.5%)

12:15 US ADP (e400k p475k)

12:30 US PCE QoQ

12:30 US Q4 GDP (YoY e7.1% p7.0%)

23:50 Japan Ind Production

Thursday March 31

00:30 Aus Building Permits

01:00 China PMIs (Mfr e49.8 p50.2)

06:00 UK Q4 GDP (QoQ e1.0% p1.0%)

06:00 Germany Retail Sales (e2.4% p10.3%)

07:55 Germany Unemployment

08:00 OPEC Meeting

09:00 Eurozone Unemployment

12:30 US PCE MoM & YoY

12:30 US Jobless Claims

12:30 US Personal Income/Spending

12:30 Canada GDP

13:00 Fed Williams speech

13:45 Chicago PMI

21:30 Aus AiG Mfg Index

23:50 Japan Tankan Mfr Indices

Friday April 1

01:45 China Caixin Mfr PMI

07:55 Germany Markit Mfr PMI

08:30 UK Markit Mfr PMI

09:00 Eurozone CPI (Core 2.8% p2.7%)

12:30 US NFP/AHE/UnEmp (NFP e450k p678k)

13:30 Canada Markit Mfr PMI

13:45 US Markit Mfr PMI

14:00 US ISM PMI (e58.5 p58.6)

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.