DAX underperformance

MY CALL THIS WEEK : SELL EURUSD

In a shortened week due to Independence Day, European divergence and underperformance came to a head on Tuesday’s re-open as DAX dropped 3% to take out its March low and EURUSD dropped through 1.035 support, reaching 1.007 on Friday. Meanwhile, the SPX easily held last week’s low. Tuesday also saw the peak of the recent recession scare, with commodities down heavily and oil lower by 11%. The data highlight of the week came from the NFP, which with a solid beat and print of +372k, tells us the US economy is holding up extremely well despite all the recession talk. Expect the Fed to raise 75bps again in July.

WEEKLY PRICE MOVEMENT

WEEKLY PRICE MOVEMENT

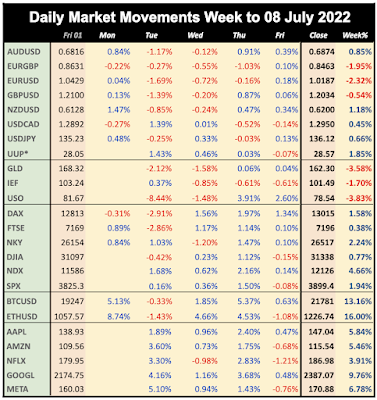

The biggest index mover this week was NDX, up 4.66%. The top forex mover was EURNZD down 2.32%. Crypto recovered sharply again, and FANG outperformed NDX.

My EURCAD long lost 1.89% this week, meaning I am now ahead 2.91% with 13/25 (52%) wins. This week I have thrown in the towel and am shorting EURUSD.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

Each month in the past the main focus was on NFP week or Fed week, but these days the most importantly monthly print is CPI, due on Wednesday. The raw figure is estimated to increase yet again to 8.7% from 8.6%, but core inflation (stripping out food and, particularly, energy) is thought to fall again as it has done since the April peak of 6.5%. If this doesn't happen it could be bad for equity markets, whereas a miss (lower) on the headline rate would imply a Fed slowdown and boost recovery.

Earnings season for Q2 also starts next week, with, as always JPM first out of the gate, reporting on Thursday with MS, followed by WFC and C on Friday (GS report the following Monday to complete the opening quintet). UNH, at nearly 11% the largest component of DJIA also report on Friday. After the worst Q1 for decades, these releases will also be key, so overall, strong moves are possible ahead.

CALENDAR (all times are GMT, volatile items in bold)

Monday, July 11

01:00 BoJ Gov Kuroda speech

18:00 US Monthly Budget Statement

Tuesday, July 12

09:00 Germany ZEW Sentiment

17:00 BoE Governor Bailey speech

Wednesday, July 13

00:30 Aus Westpac Consumer Confidence

02:00 China Imports/Exports/TB

06:00 UK GDP MoM

06:00 UK Ind/Mfr Production

06:00 Germany CPI (e8.7% p8.2%)

12:30 US CPI (Core e5.9% p6.0%)

14:00 BoC Rate Decision/Statement (e2.25% p1.5%)

15:00 BoC Press Conference

18:00 US Fed Beige Book

Thursday, July 14

01:00 Aus Consumer Inflation Expectations

01:30 Aus Jobs/UnEmp (Jobs e25k p60.6k)

04:30 Japan Ind Production

12:30 US Jobless Claims

12:30 US PPI

Friday, July 15

02:00 China GDP (QoQ e0.6% p1.3%)

02:00 China Ind Production

02:00 China Retail Sales (YoY e-7.1% p-6.7%)

12:30 US Retail Sales (MoM e-0.8% p-0.3%)

13:00 US Fed Index of Common Inflation Expectations (time approx.)

14:00 Michigan CSI (e58 p50)