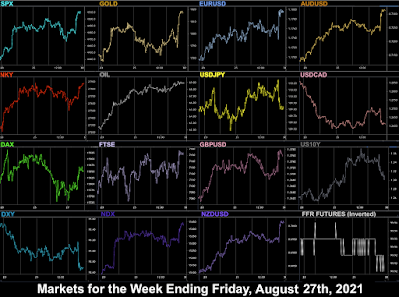

In a week where strong action came on Monday’s ramp higher in stocks and oil, bad news/data was perceived as good for the market. Weak PMIs and Capital Goods reports globally dampened expectations for a taper announcement in the week’s main event at Jackson Hole and sent the SPX and NDX to new all-time highs. Powell’s Friday Jackson Hole speech confirmed that the inflation target had been met (no more talk of ‘transitory’) but that further job recovery was needed. This was more dovish than expected, and pushed stocks up further, and the dollar sharply down.

Next week is the final week before the vacation season ends on Labor Day. A new month means of course NFP, and the estimate of 763k is in line with previous months. This print is crucial, as Fed Chair Powell indicated last week that with the inflation target met, only

CALENDAR

High volatility items in bold

09:00 Eurozone Consumer/Industrial Confidence(Aug)

12:00 Germany CPI (e2.9% p3.1%)

12:30 Canada Current Account(Q2)

14:00 US Pending Home Sales

23:30 Japan Jobs/Unemployment

Tuesday August 31

01:00 China NBS PMIs (Services e50.8 p50.4)

01:00 Aus TD Securities Inflation

01:30 Aus Building Permits

07:55 Germany Unemployment

09:00 Eurozone CPI (YoY 2.5% p2.2%)

12:30 Canada Q2 Final GDP (e6.7% p5.6%)

13:00 US Housing/Home Price Indices

13:45 Chicago PMI

14:00 US Consumer Confidence

22:30 Aus AiG Performance of Mfg Index

01:45 Caixin Mfr PMI

06:00 Germany Retail Sales (e3.2% p6.2%)

07:55 Germany Markit Mfr PMI

08:30 UK Markit Mfr PMI

09:00 Eurozone Unemployment

12:15 US ADP Employment Change (e575k p330k)

13:30 Canada Markit Mfr PMI

13:45 US Markit Mfr PMI

14:00 ISM Mfr PMI (e59.1 p59.5)

01:30 Aus Imports/Exports/TB (TB p-10.5B)

12:30 US Trade Balance

12:30 US Jobless Claims

12:30 Canada Trade Balance

14:00 US Factory Orders

22:30 Aus AiG Performance of Construction Index

23:00 Aus Commonwealth Bank Services PMI

01:45 China Caixin Services PMI

07:55 Germany Markit Composite PMI

08:00 Eurozone Markit Composite PMI

09:00 Eurozone Retail Sales (p5.0%)

12:30 US NFP/AHE/UnEmp (e763k p943k)

13:45 US Markit Services PMI

13:45 US Markit Composite PMI

14:00 ISM Services PMI (e63.0 p64.1)