SPX & NDX ATH, Dollar falls after Jackson Hole

MY CALL THIS WEEK : BUY GBPAUD

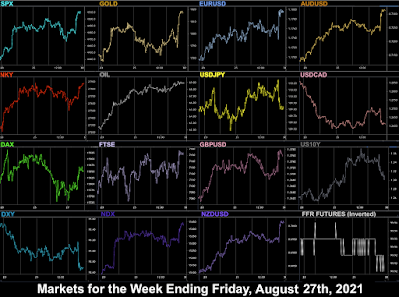

In a week where strong action came on Monday’s ramp higher in stocks and oil, bad news/data was perceived as good for the market. Weak PMIs and Capital Goods reports globally dampened expectations for a taper announcement in the week’s main event at Jackson Hole and sent the SPX and NDX to new all-time highs. Powell’s Friday Jackson Hole speech confirmed that the inflation target had been met (no more talk of ‘transitory’) but that further job recovery was needed. This was more dovish than expected, and pushed stocks up further, and the dollar sharply down.

This meant that USD failed to hold last week’s break to new 2021 highs, posting an inside week. EURUSD spent the majority of the week above 1.17, also having an inside week as did the majority of currencies. Gold however broke out to a 3-week high. Yields surprisingly held up despite the dollar decline, and Oil fully reversed last week’s decline in line with the equity risk-on move.

Meanwhile, developments in New Zealand continue to be interesting, particularly as they are the G10 bank most advanced in normalizing rates. Assistant Governor Christian Hawkesby told Bloomberg that they were ready to raise rates last week and that policy decisions are not tightly linked to COVID and lockdowns. However, they held back on the hike as it would have been announced on the same day as the start of a national lockdown.

WEEKLY PRICE MOVEMENT

The biggest mover this week was NKY, up 2.32%. The top forex mover was again AUDJPY this week up 2.58%. Crypto was extremely flat, I cannot remember seeing weekly moves of less than 1%. FANGs were strong, following the risk-on NDX.

My CADJPY buy made 1.44% taking my year to date profit to 6.85% and 24/33 wins. This week I am buying GBPAUD as it is at support.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK (all times are GMT)

Next week is the final week before the vacation season ends on Labor Day. A new month means of course NFP, and the estimate of 763k is in line with previous months. This print is crucial, as Fed Chair Powell indicated last week that with the inflation target met, only

Otherwise, the week is packed with non-US data, including Eurozone and German inflation, Japanese and German Retail Sales, and PMIs from every territory including the important US ISM prints, both of which estimate slight pullbacks.

CALENDAR

High volatility items in bold

Monday August 30

23:50 Japan Retail Sales (Sun)

09:00 Eurozone Consumer/Industrial Confidence(Aug)

12:00 Germany CPI (e2.9% p3.1%)

12:30 Canada Current Account(Q2)

14:00 US Pending Home Sales

23:30 Japan Jobs/Unemployment

09:00 Eurozone Consumer/Industrial Confidence(Aug)

12:00 Germany CPI (e2.9% p3.1%)

12:30 Canada Current Account(Q2)

14:00 US Pending Home Sales

23:30 Japan Jobs/Unemployment

Tuesday August 31

01:00 China NBS PMIs (Services e50.8 p50.4)

01:00 Aus TD Securities Inflation

01:30 Aus Building Permits

07:55 Germany Unemployment

09:00 Eurozone CPI (YoY 2.5% p2.2%)

12:30 Canada Q2 Final GDP (e6.7% p5.6%)

13:00 US Housing/Home Price Indices

13:45 Chicago PMI

14:00 US Consumer Confidence

22:30 Aus AiG Performance of Mfg Index

Wednesday September 1

01:30 Aus Q2 Final GDP (e1.6% p1.8%(

01:45 Caixin Mfr PMI

06:00 Germany Retail Sales (e3.2% p6.2%)

07:55 Germany Markit Mfr PMI

08:30 UK Markit Mfr PMI

09:00 Eurozone Unemployment

12:15 US ADP Employment Change (e575k p330k)

13:30 Canada Markit Mfr PMI

13:45 US Markit Mfr PMI

14:00 ISM Mfr PMI (e59.1 p59.5)

01:45 Caixin Mfr PMI

06:00 Germany Retail Sales (e3.2% p6.2%)

07:55 Germany Markit Mfr PMI

08:30 UK Markit Mfr PMI

09:00 Eurozone Unemployment

12:15 US ADP Employment Change (e575k p330k)

13:30 Canada Markit Mfr PMI

13:45 US Markit Mfr PMI

14:00 ISM Mfr PMI (e59.1 p59.5)

Thursday September 2

01:30 Aus Imports/Exports/TB (TB p-10.5B)

12:30 US Trade Balance

12:30 US Jobless Claims

12:30 Canada Trade Balance

14:00 US Factory Orders

22:30 Aus AiG Performance of Construction Index

23:00 Aus Commonwealth Bank Services PMI

01:30 Aus Imports/Exports/TB (TB p-10.5B)

12:30 US Trade Balance

12:30 US Jobless Claims

12:30 Canada Trade Balance

14:00 US Factory Orders

22:30 Aus AiG Performance of Construction Index

23:00 Aus Commonwealth Bank Services PMI

Friday September 3

01:45 China Caixin Services PMI

07:55 Germany Markit Composite PMI

08:00 Eurozone Markit Composite PMI

09:00 Eurozone Retail Sales (p5.0%)

12:30 US NFP/AHE/UnEmp (e763k p943k)

13:45 US Markit Services PMI

13:45 US Markit Composite PMI

14:00 ISM Services PMI (e63.0 p64.1)

01:45 China Caixin Services PMI

07:55 Germany Markit Composite PMI

08:00 Eurozone Markit Composite PMI

09:00 Eurozone Retail Sales (p5.0%)

12:30 US NFP/AHE/UnEmp (e763k p943k)

13:45 US Markit Services PMI

13:45 US Markit Composite PMI

14:00 ISM Services PMI (e63.0 p64.1)

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.