Highest #CPI for 40 years. Yields and Oil at multi-year highs

MY CALL THIS WEEK : BUY EURGBP

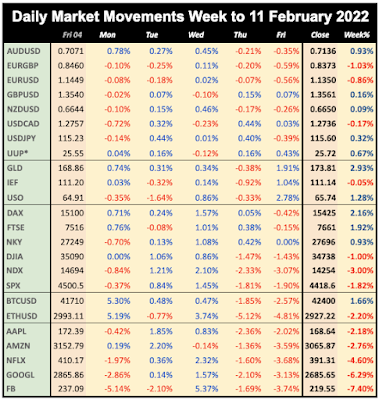

As is often the case, markets were progressing gently only to be hit by the worse than expected CPI print on Thursday, which at 7.5% was the highest for 40 years. Higher inflation implies earlier rate hikes, and Fed hawk Bullard said “I'd like to see 100 basis points in the bag by July 1." Indices pulled back with SPX closing an inside week, and rate-sensitive NDX down 3%. The effect was largely confined to the US, and DAX and FTSE were up on the week. Although the dollar briefly spiked on the CPI release, it quickly retraced and also had an inside week, although Gold was well up, making a 12-week and 2022 high. Oil reached $94, a six-year high, and yields crossed 2% for the first time since July 2019.

WEEKLY PRICE MOVEMENT

WEEKLY PRICE MOVEMENT

The biggest index mover was again NDX, down 3.0%. The top forex mover was EURAUD down 1.79%. Bitcoin and Ethereum were flat, and FANG suffered again, falling more than NDX in aggregate.

Last week's AUDNZD long position made 0.84%, which means I am ahead 3.31% this year, with 3/5 (60%) wins. This week I am buying EURGBP as I think it has bounced off the 0.83 bottom, but pulled back last week, making a good entry.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

Next week’s US data is light, only Retail Sales (which is not rising with inflation). The all-important inflation releases come from China (low), the UK and Canada (high but not as high as US). FOMC minutes probably the main US takeaway. Everything is about inflation. Earnings season enters the ‘retail’ phase when WMT report on Thursday.

CALENDAR (all times are GMT, volatile items in bold)

Monday February 14

23:50 Japan Q4 Prelim GDP (QoQ e1.4% p-0.9%)

23:50 Japan Q4 Prelim GDP (QoQ e1.4% p-0.9%)

Tuesday February 15

00:30 RBA MPC Minutes

04:30 Japan Ind Production

07:00 UK Claimant Count/AHE/UnEmp (UnEmp e4.1% p4.1%)

10:00 Eurozone Q4 Prelim GDP (YoY e4.6% p4.6%)

10:00 Germany ZEW Sentiment Surveys

13:30 US PPI

00:30 RBA MPC Minutes

04:30 Japan Ind Production

07:00 UK Claimant Count/AHE/UnEmp (UnEmp e4.1% p4.1%)

10:00 Eurozone Q4 Prelim GDP (YoY e4.6% p4.6%)

10:00 Germany ZEW Sentiment Surveys

13:30 US PPI

Wednesday February 16

01:30 China CPI (e1.0% p1.5%)

07:00 UK CPI (e5.4% p5.4%)

10:00 Eurozone Ind Production

10:30 DE10Y Bond Auction (time approx.)

13:30 US Retail Sales (Control e0.1% p-3.1%)

13:30 Canada BoC CPI (e4.6% p4.0%)

18:30 BoC Lane speech

19:00 FOMC Minutes

23:50 Japan Imports/Exports/TB

01:30 China CPI (e1.0% p1.5%)

07:00 UK CPI (e5.4% p5.4%)

10:00 Eurozone Ind Production

10:30 DE10Y Bond Auction (time approx.)

13:30 US Retail Sales (Control e0.1% p-3.1%)

13:30 Canada BoC CPI (e4.6% p4.0%)

18:30 BoC Lane speech

19:00 FOMC Minutes

23:50 Japan Imports/Exports/TB

Thursday February 17

00:30 Aus NFP/UnEmp (NFP e-15k p64.8k)

09:00 Eurozone Economic Bulletin

13:30 US Building Permits/Housing Starts

13:30 US Jobless Claims

13:30 Philly Fed Mfr Survey

23:30 Japan National CPI

00:30 Aus NFP/UnEmp (NFP e-15k p64.8k)

09:00 Eurozone Economic Bulletin

13:30 US Building Permits/Housing Starts

13:30 US Jobless Claims

13:30 Philly Fed Mfr Survey

23:30 Japan National CPI

Friday February 18

07:00 UK Retail Sales

13:30 Canada Retail Sales (e1.2% p0.7%)

15:00 Eurozone Consumer Confidence

07:00 UK Retail Sales

13:30 Canada Retail Sales (e1.2% p0.7%)

15:00 Eurozone Consumer Confidence

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.