Russia invades Ukraine. Markets recover in hours.

MY CALL THIS WEEK : SELL EURNZD

LAST WEEK

As we mentioned last week, the primary driver of markets this week was the invasion of Ukraine by Russia, the first war on European soil since the Kosovo in 1999. Markets fell hard on Thursday morning and gold, oil and the dollar surged in classic form. However, the moves were quickly reversed, and SPX and NDX both ended the week up, and DJIA was flat. The dollar and yields were up overall, the latter not really reacting to the Ukraine issue. The RBNZ rate hike was priced in, and had no effect on NZD. Gold and oil both tracked the dollar.

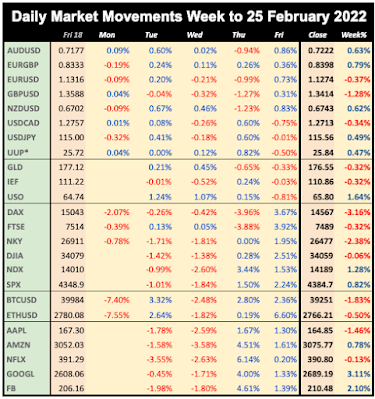

WEEKLY PRICE MOVEMENT

The biggest index mover was Ukraine-sensitive DAX, down 3.16%. The top forex mover was GBPAUD up 1.91%. Bitcoin and Ethereum were flat, as was FANG.

Last week's AUDNZD long position made 0.08%, which means I am ahead 2.91% this year, with 4/7 (57%) wins. I think EUR is going to react to Ukraine, and so sell it against NZD. I am avoiding AUD as there is a rate decision statement.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

Next week sees a new month, and therefore NFP, which at 400k estimate is similar to last month's print. Ukraine is still expected to dominate the general headlines, although Australian and Canadian rate decisions and Aussie and Canadian inflation will have an effect in the forex area.

CALENDAR (all times are GMT, volatile items in bold)

NEXT WEEK

Next week sees a new month, and therefore NFP, which at 400k estimate is similar to last month's print. Ukraine is still expected to dominate the general headlines, although Australian and Canadian rate decisions and Aussie and Canadian inflation will have an effect in the forex area.

CALENDAR (all times are GMT, volatile items in bold)

Monday February 28

23:50 Japan Ind Production (Sun)

23:50 Japan Retail Sales (Sun)

00:00 Aus TD Securities Inflation

00:30 Aus Retail Sales (p-4.4%)

13:30 Canada Current Account

14:45 Chicago PMI

21:30 Aus AiG Mfg Index

Tuesday March 1

01:00 China PMIs

01:45 China Caixin Mfr PMI

03:30 RBA Rate Decision/Statement (e0.1% hold)

07:00 Germany Retail Sales (p0%)

08:55 Germany Markit Mfr PMI

09:30 UK Markit Mfr PMI

13:00 Germany CPI (e5.3% p5.1%)

13:30 Canada Q4 GDP (p5.4%)

14:30 Canada Markit Mfr PMI

14:45 US Markit Mfr PMI

15:00 ISM Mfr PMI (e58.0 p57.6)

18:30 BoE Saunders speech

Wednesday March 2

00:30 Australia Q4 GDP (e0.5% p-1.9%)

08:55 Germany UnEmp Change/Rate

10:00 Eurozone HICP (CPI) (Core p2.3%)

10:30 DE10Y Bond Auction

13:15 US ADP (e328k p-301k)

15:00 BoC Rate Decision/Statement (e0.25% hold)

19:00 Fed Beige Book

20:00 BoE Cunliffe speech

21:30 Aus AiG Construction Index

22:00 Aus Commonwealth Bank Services PMI

Thursday March 3

00:30 Aus Imports/Exports/TB (TB p8.36B)

01:45 China Caixin Services PMI

08:55 Germany Markit Comp PMI

09:00 Eurozone Markit Comp PMI

10:00 Eurozone UnEmp Rate

12:30 ECB MPC Minutes

13:30 US Jobless Claims

14:45 US Markit Comp/Svcs PMIs

15:00 US Factory Orders

15:00 ISM Svcs PMI (e 61 p59.9)

23:30 Japan Jobs/UnEmp

Friday March 4

07:00 Germany Trade Balance

10:00 Eurozone Retail Sales (p2%)

13:30 US NFP/AHE/UnEmp (NFP e400k p467k)

15:00 Canada Ivey PMI

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.