Hawkish Fed boosts USD, Equities consolidate.

MY CALL THIS WEEK : BUY GBPAUD

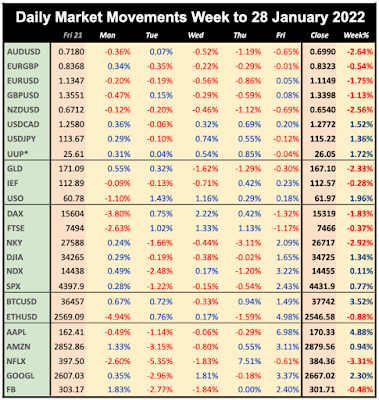

The strong volatility continued this week, but ultimately as consolidation as SPX and NDX touched 7-month lows, but ultimately closed the week slightly up, helped by the AAPL beat. The hawkish Fed gave a strong boost to the dollar, up 1.72% to an 18-month high, all currencies and Gold were down in line, although yields were nearly flat, some of the Fed mood being already priced in. Oil hit new seven year highs on the Russia/Ukraine tension, and NatGas was also up.

WEEKLY PRICE MOVEMENT

WEEKLY PRICE MOVEMENT

The biggest index mover was NKY, down 2.92%. The top forex mover was AUDUSD down 2.64%. Bitcoin and Ethereum stabilised, and FANG was variable again, with NFLX falling further.

Last week's NZDUSD short position made 2.56%, which when added to last week’s 0.07%, means I am ahead 2.63%, with 2/3 (66%) wins. This week I will buy GBPAUD expecting a BoE rate hike.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

In another packed week into the new month, for once NFP is not the primary driver, as we have earning from the rest of FANG (GOOGL, FB and AMZN). Will they buck the trend, and follow stablemate AAPL with a strong beat. Also next week are three rate decisions, the most important being the ECB. The same day sees a possible 25bp hike from the BoE.

CALENDAR (all times are GMT)

Monday January 31

23:50 Japan Retail Sales/Ind Production (Sunday)

01:00 China PMIs (Mfr e50.0 p50.3)

10:00 Eurozone Q4 GDP (QoQ e0.3% p2.2%)

13:00 Germany CPI (e5.7%)

14:45 Chicago PMI

21:30 Australia AiG Mfg Index

23:30 Japan Jobs/Unemployment

Tuesday February 1

00:30 Australia Retail Sales (MoM e3.9% p7.3%)

03:30 RBA Rate Decision/Statement (e0.1% p0.1%)

07:00 Germany Retail Sales (e-4.9% p-2.9%)

08:55 Germany Markit Mfr PMI

08:55 Germany UnEmp Change/Rate

09:00 ECB Bank Lending Survey

09:30 UK Markit Mfr PMI

10:00 Eurozone Unemployment Rate(Dec)

13:30 Canada Q4 GDP (MoM(

14:30 Canada Markit Mfr PMI

14:45 US Markit Mfr PMI

15:00 ISM Mfr PMI (e58.3 p58.7)

Wednesday February 2

01:30 RBA Governor Lowe speech

09:00 OPEC Meeting

10:00 Eurozone CPI (YoY p5.0%)

13:15 US ADP Employment Change (e250k p807k)

15:00 BoC Gravelle speech

21:30 AiG Construction Index

22:00 Aus Commonwealth Bank Svcs PMI

Thursday February 3

00:30 Aus Imports/Exports/TB (P9.42B)

00:30 NAB Business Confidence

08:55 Germany Markit Comp PMI

09:00 Eurozone Markit Comp PMI

12:00 BoE Rate Decision/Statement (e0.50% p0.25%)

12:30 BoE Governor Bailey speech

12:45 ECB Rate Decision/Statement (e0% unch)

13:30 ECB Lagarde Presser

13:30 US Jobless Claims

14:45 US Markit Comp & Svcs PMI

15:00 US ISM Services PMI (e61.8 p62.0)

Friday February 4

00:30 RBA MPC Minutes

07:00 Germany Factory Orders

10:00 Eurozone Retail Sales (p7.8%)

13:30 US NFP/AHE/UnEmp (NFP e238k p199k)

13:30 Canada NFP/UnEmp (UnEmp

15:00 Canada Ivey PMI

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.