CPI highest since 1982, Oil at 6-year closing high

MY CALL THIS WEEK : SELL NZDCAD

THIS WEEK

Markets were weak this week. There was an initial spike down and recovery into the Powell hearings (less hawkish than expected), and then the post-Santa sell-off moved into consolidation, with the 7% inflation print, the highest since 1982 spooking markets into giving back early gains, resulting in a flat week. The dollar fell all week, accelerated by the CPI figure, as did yields, although the latter was after the huge move up last week. Incidentally 10-year yields hit the 200-week moving average for the first time since May 2019. Oil made a 6-year closing high on Friday as last week's rally continued. Gold continued to consolidate, erasing half of last week's gains. Earnings on Friday had little effect, JPM only beat estimates with a one-off credit, and along with C the stock fell on Friday.

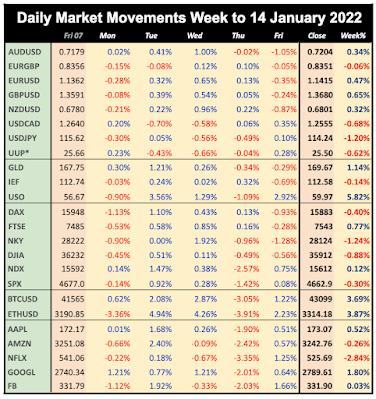

WEEKLY PRICE MOVEMENT

The biggest index mover was NKY, down 1.44%. The top forex mover was USDJPY down 1.20%. Bitcoin and Ethereum fall ended, and the pair were slightly up. FANG was variable, although less volatile than in previous weeks.

Last week's NZDCAD long position lost 0.26%, which when added to last week’s 0.33%, means I am ahead 0.07%, with 1/2 (50%) wins. This week I try buying NZDCAD again, as Oil is as a double-top.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

Monday is the MLK Day holiday in the US only, and earnings season starts properly on Tuesday with GS reporting before the bell, followed in the week by Dow giants PG and UNH, and first of the FANGs NFLX on Thursday after the bell. The week sees a raft of inflation reports from the UK, Canada, Germany, Eurozone and Japan on Wednesday and Thursday, and a rate decision on the yen. Friday is January's OpEx day.

CALENDAR (all times are GMT)

Monday January 17

02:00 China GDP (QoQ e1.1% p0.9%)

02:00 China Retail Sales (e3.7% p3.9%)

15:30 BoC Business Outlook Survey

Tuesday January 18

03:00 BoJ Rate Decision/Statement (e-0.1% hold)

04:30 Japan Industrial Production

06:00 BoJ Press Conference

07:00 UK Claimant Count/UnEmp/AHE (UE e4.2% p4.2%)

10:00 Germany ZEW Sentiment Surveys

Wednesday January 19

07:00 UK CPI (p5.1%)

07:00 Germany CPI (e5.7% p5.7%)

13:30 US Building Permits/Housing Starts

13:30 Canada BoC CPI (e3.6% p3.6%)

14:15 BoE Gov Bailey Speech

23:30 Aus Westpac Consumer Confidence

23:50 Japan Imports/Exports/TB

Thursday January 20

00:30 Aus NFP/UnEmp (UE e4.5% p4.6%)

01:30 PBoC Rate Decision/Statement (e3.8% hold)

07:00 Germany PPI

10:00 Eurozone CPI

12:30 ECB MPC Minutes

13:30 US Jobless Claims

13:30 Philly Fed Mfr Survey

23:30 Japan National CPI

23:50 BoJ MPC Minutes

Friday January 21

07:00 UK Retail Sales

13:30 Canada Retail Sales (e1.0% p1.6%)

15:00 Eurozone Consumer Confidence

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.