THIS WEEK

A new year, and stocks initially continued upwards this week, but were halted by hawkish remarks in the Fed minutes, which depressed indices generally and tech stocks particularly, already sensitive to omicron COVID, reflected in the US ISM PMI miss. The weak NFP (199k vs 400k) did not help. Naturally yields rallied on the Fed, hitting a 9-month high, although notably the effect was not seen in the dollar, except against commodity currencies AUD and NZD. (CAD was protected by a rally in Oil caused by OPEC sticking to their production schedule). Gold fell in line with yields.

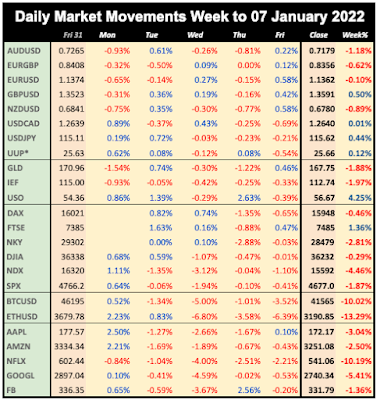

WEEKLY PRICE MOVEMENT

The biggest index mover was NDX, down 4.46%, much more than the other indices, showing the effect of the Fed remarks. The top forex mover was AUDJPY down 1.68%. Bitcoin and Ethereum were well down again, and FANG performed in line with NDX.

My total forex profit for 2021 was 6.49% with 36/52 wins. Last week’s CADJPY short made 0.33%, a win for the first week in 2022. This week I will buy NZDCAD.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

The most important macro print this week is US inflation on Wednesday. The estimate of 5.4% is the highest for 30 years. Earnings season starts this week, but only just, with JPM (as always), C, and WFC reporting on Friday. Fed Chair Powell has his second term confirmation hearing, otherwise we have Chinese inflation (only 1.8%!), and US and Australian Retail Sales.

CALENDAR (all times are GMT)

Monday January 10

00:00 Aus TD Securities Inflation (time approx.)

00:30 Aus Building Permits

10:00 Eurozone Unemployment Rate(Nov)

Tuesday January 11

00:30 Aus Imports/Exports/TB (TB e10.6B p-11.2B)

00:30 Aus Retail Sales (e4% p4.9%)

15:00 Fed Chair Powell testifies

23:50 Japan Current Account

Wednesday January 12

00:00 Aus HIA New Home Sales (time approx.)

01:30 China CPI (e1.8% p2.3%)

10:00 Eurozone Industrial Production

13:30 US CPI (Core YoY e5.4% p4.9%)

19:00 US Monthly Budget Statement

Thursday January 13

00:00 Aus Consumer Inflation Expectations

02:00 China Imports/Exports/TB

13:30 US Jobless Claims

13:30 US PPI

Friday January 14

07:00 UK GDP (MoM)

07:00 UK Ind/Mfr Production

13:30 US Retail Sales (Control Group Dec p-0.1%)

15:00 Michigan CSI (e70.6 p70.6)

No comments:

Post a Comment

Please leave a comment. They are moderated and spam (links to your site) will not be published.