Rally stalls in stocks and bonds

MY CALL THIS WEEK : BUY EURJPY

The week started with Memorial Day and a hawkish speech from known Fed hawk Christopher Waller, talking about 50bp hikes at every meeting until inflation is tamed, even running past the ‘neutral rate’ of 2.5%. Following that, just as last week’s poor data was read by the market as potentially delaying tightening, this week a run of good data, including Tuesday’s Chicago PMI (60.3 vs 55!) and Wednesday’s ISM PMI (56.1 vs 54.5), led to a small reversal of last week’s rally, but overall a much less volatile week that we have seen recently.

A similar theme from the even more hawkish (so therefore you’d expect 75bp or something, which he didn’t say) James Bullard temporarily arrested the decline, and Thursday’s misses on ADP and Factory Orders, following the bad=good theme helped SPX add 2.73% from the double-bottom low of the week, but still close 1.20% down on the week. NFP was a beat which fuelled the decline further, and as we predicted last week, did not essentially alter the trend.

In Europe, inflation data was worse than expected with Germany reporting 8.7% vs 8%, and Eurozone 8.1% vs 7.7% (core 3.8% vs 3.5%). Nevertheless DAX and FTSE closed flat on the week, the latter only trading for three days.

Currencies were fairly flat, except for JPY which fell again as US yields started to climb again. USDJPY had its highest weekly close for 20 years. Oil rallied again by 4.69% to its highest weekly close since 2008. Fed Williams speech and SEC consumer video about cryptocurrencies led to a 7.7% drop in BTC, back under $30,000. It had not recovered by the end of the week.

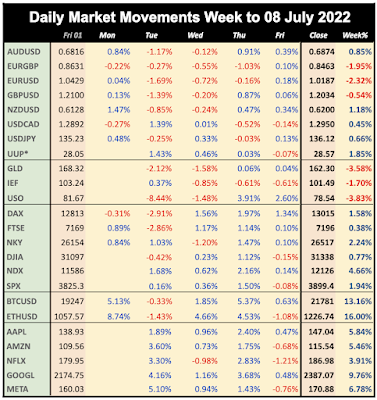

WEEKLY PRICE MOVEMENT

The biggest index mover this week was NKY, up 3.66%. The top forex mover was again USDJPY up 2.94%. Crypto had a volatile week ending slightly up, and FANGs notably outperformed NDX as a whole.

Last week's USDJPY short was the worst trade I could take, losing 2.94%, which means I am ahead 5.58% this year, with 11/20 (55%) wins. This week I am buying EURJPY on the hope of a hawkish ECB, and that JPY must pull back eventually.

Note we use Google Finance data for daily movements, listing UUP as a proxy for DXY. All references to ‘the dollar’ are based on DXY. The equity and index prices are now based on the cash close each day.

NEXT WEEK

The key release next week is the US inflation print on Friday where a slight but welcome reduction from 8.3% to 8.2% and core 6.2% to 5.9% is expected. Markets will definitely move whatever the print is, even coming as estimated would be a fillip to equities.

Otherwise the main events are outside the US with the RBA and ECB rate decisions. The RBA is expected to hike by 25bp, with some forecasters predicting a 40bp increase (meaning 25bp could depress AUD). The hawkish bar is also high for the ECB, the only currency area not to have raised rates or terminated QE yet. The single currency has come off multi-year lows recently, but this recovery could threatened unless the ECB take some action. The ECB has previously said it will not raises until it has ended bond buying.

CALENDAR (all times are GMT, volatile items in bold)

Monday June 6

01:00 Aus TD Securities Inflation

01:45 China Caixin Services PMI

23:30 Japan Overall Household Spending

Tuesday June 7

04:30 RBA Rate Decision/Statement (e0.60% p0.35%)

06:00 Germany Factory Orders

12:30 US Trade Balance

12:30 Canada Trade Balance

14:00 Canada Ivey PMI

23:50 Japan Q1 Final GDP (e-0.2% p-0.2%)

Wednesday June 8

09:00 Eurozone Q1 Final GDP (QoQ e0.3% p0.3%)

09:30 DE10Y Auction

Thursday June 9

02:00 China Imports/Exports/TB

11:45 ECB Rate Decision/Statement (e0% hold)

12:30 ECB Pres Lagarde Presser

12:30 US Jobless Claims

Friday June 10

01:30 China CPI (p2.1%)

12:30 US CPI (Core e5.9% p6.2%)

12:30 Canada NFP/AHE/UnEmp (NFP p15.3k)

14:00 Michigan CSI (e56.9 p58.4)

18:00 US Monthly Budget Statement